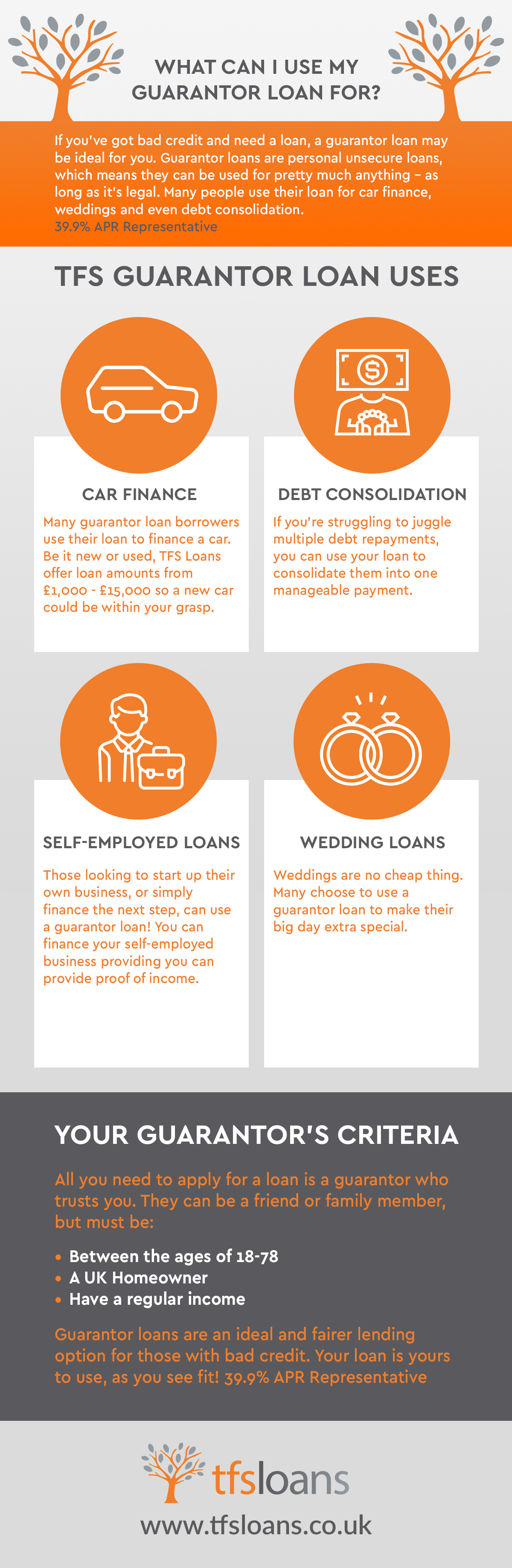

What can I use my Guarantor Loan for?

If you’ve got bad credit and need a loan, a guarantor loan may be ideal for you. Guarantor loans are personal unsecure loans, which means they can be used for pretty much anything – as long as it’s legal. Many people use their loan for car finance, weddings and even debt consolidation. TFS Guarantor Loan Uses

- Car Finance – Many guarantor loan borrowers use their loan to finance a car. Be it new or used, TFS Loans offer loan amounts from £1,000 – £15,000 so a new car could be within your grasp.

- Debt Consolidation – If you’re struggling to juggle multiple debt repayments, you can use your loan to consolidate them into one manageable payment.

- Self-Employed Loans – Those looking to start up their own business, or simply finance the next step, can use a guarantor loan! You can finance your self-employed business providing you can provide proof of income.

- Wedding Loans – Weddings are no cheap thing. Many choose to use a guarantor loan to make their big day extra special.

Your Guarantor’s Criteria All you need to apply for a loan is a guarantor who trusts you. They can be a friend or family member, but must be:

- Between the ages of 18-78

- A UK Homeowner

- Have a regular income

Guarantor loans are an ideal and fairer lending option for those with bad credit. Your loan is yours to use, as you see fit! 44.9% APR Representative  TFS Loans are specialist Guarantor Loan lenders. A Guarantor Loan is a form of loan that requires someone to act as the Borrower’s Guarantor. We offer Guarantor Loans from £1,000 to £15,000, over 1 to 5 years.

TFS Loans are specialist Guarantor Loan lenders. A Guarantor Loan is a form of loan that requires someone to act as the Borrower’s Guarantor. We offer Guarantor Loans from £1,000 to £15,000, over 1 to 5 years.

44.9% APR Representative

0203 476 4170

0203 476 4170